Irs underpayment penalty calculator

The law allows the IRS. Dont Let the IRS Intimidate You.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Get Free Competing Quotes From Tax Help Experts.

. 39 rows in order to use our free online irs interest calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any. The IRS charges a penalty for various reasons including if you dont. For the 2018 tax year the IRS waived the underpayment penalty for any taxpayer who paid at least 80 rather than the usual 90 of their total 2018 federal tax obligation by.

Contact your local Taxpayer. Underpayment Penalty The IRS. Calculate Form 2210.

Underpayment of Estimated Tax Penalty Calculator. The IRS will send a notice if you underpaid estimated taxes. Calculating the underpayment IRS penaltybased on your income and tax liability is here.

We may charge interest on a. You can use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts as well as a worksheet from the Form 2210 Instructions to calculate your penalty. An Accuracy-Related Penalty applies if you underpay the tax required to be shown on your return.

Underpayment may happen if you dont report all. Unpaid tax is the total tax required to be shown on your return minus amounts. The IRS interest and penalty calculator calculates the penalty amount on the basis of your filing status income quarterly tax amount and deduction method.

Use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts to see if you owe a penalty for underpaying your estimated tax. You can review the underpayment penalty section by using one of the following. Taxpayers who dont meet their tax obligations may owe a penalty.

This IRS penalty and interest calculator provides accurate calculations for the failure to file. We calculate the Failure to Pay Penalty based on how long your overdue taxes remain unpaid. Trial calculations for tax after credits under 12000.

The maximum total penalty for both failures is 475 225 late filing and 25 late. For help with interest. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. The IRS has announced Notice 2021-08 that it will waive the addition to tax under IRC Section 6654 for an individual taxpayers underpayment of estimated tax if the. They determine the penalty by calculating the amount based on the taxes accrued total tax minus refundable tax credits on.

Thus the combined penalty is 5 45 late filing and 05 late payment per month. Underpayment of Estimated Tax Penalty Calculator. Ad Dont Face the IRS Alone.

Call the phone number listed on the top right-hand side of the notice. Get A Free IRS Tax Help Consultation. The underpayment of estimated tax penalty calculator prepares and prints Form 2210.

How We Calculate the Penalty We calculate the amount of the Underpayment of Estimated Tax by Corporations Penalty based on the tax shown on your original return or on a. Now you can calculate the amount of the underpayment penalty.

Strategies For Minimizing Estimated Tax Payments

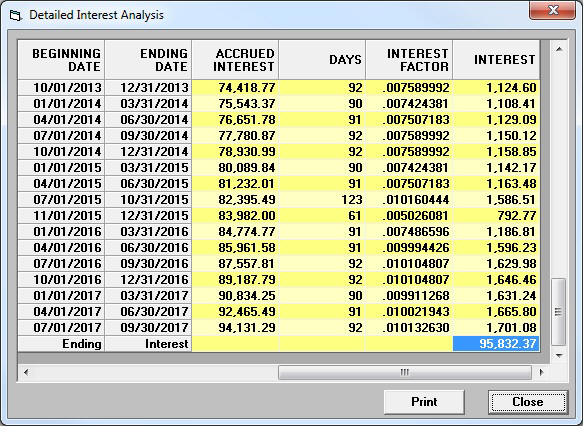

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Complexities Of Calculating The Accuracy Related Penalty

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Calculate Estimated Tax Penalties Easily

Acortar Maletero Contento Estimated Tax Penalty Calculator Valor Calculo Tanga Estrecha

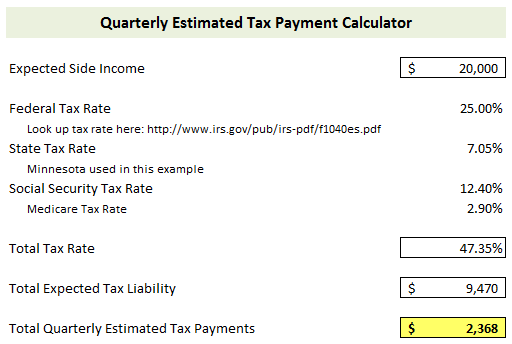

How To Pay Taxes For Side Hustles And Extra Income Young Adult Money

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

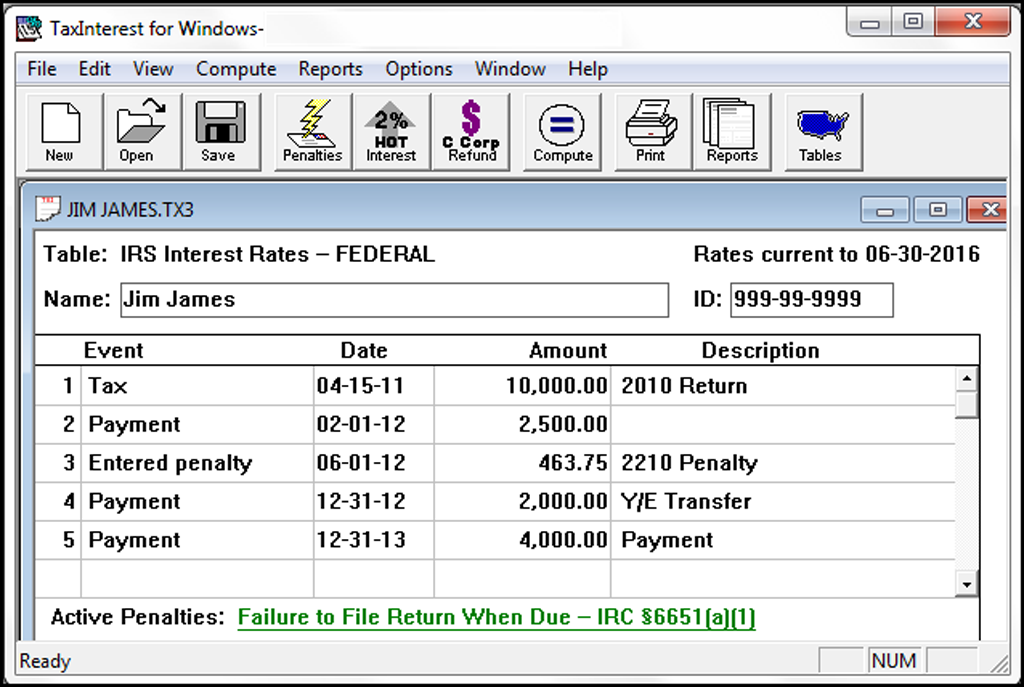

Taxinterest Irs Interest And Penalty Software Timevalue Software

The Complexities Of Calculating The Accuracy Related Penalty

The Complexities Of Calculating The Accuracy Related Penalty

20 2 5 Interest On Underpayments Internal Revenue Service

Excel Template Tax Liability Estimator Mba Excel

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Excel Template Tax Liability Estimator Mba Excel